Bobby Bonilla: fixed income investor

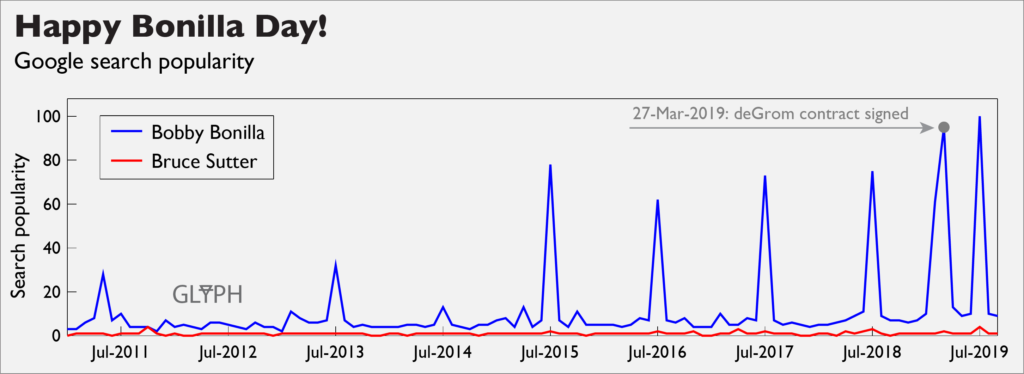

We goofed on the Mets’ owners in a previous article for paying Bobby Bonilla over $1M/year until 2035. This is sort of a tradition in certain corners of the internet, typically ramping up around July 1, when he gets paid.

Jacob deGrom’s contract negotiation and signing can be correlated with the recent non-July spike in interest; that contract’s terms were superficially similar enough for the Post to call him “the next Bonilla”1.

Some explanation may be warranted. In 1999, Bonilla had kind of a bad year2 for the Mets. The team owed him $5.9M for the year 2000 season, and decided they would rather spread that cost out, deferring any payment until 2011, then paying him until 2035 in equal installments compounded at an 8% rate3. The numbers are a little bit startling—the Mets will be paying him $29.8M to avoid paying him $5.6M—but it’s just compound interest.

It’s also not a terribly uncommon practice in sports 4, so why has a deferred money arrangement given rise to a minor internet holiday? You can’t overlook the #LOLMets explanation, but I suspect that the Bonilla contract became a Thing partially because of the “third” party involved in the contract—the Wilpons were investors with Bernie Madoff5 seeing (they thought) better than the 8% return they were promising Bonilla. That’s obviously wild speculation, but there’s probably a reason that Bonilla’s deferred contract is more richly debated than the arguably more egregious one given to Bruce Sutter6; a movie is only as good as its villain.

So should the 8% rate of return Bobby Bonilla received on his $5.9M contract have been a red flag? Should some person have said, “No, paying a 72 year old man over a million dollars to have avoided playing baseball for you is in fact abnormal, and I am going to look into what feature of the Mets financing makes this possible”? We can investigate this by forgetting that this is about a baseball player, and turning Our Hero into some guy that has decided to loan the Mets a bunch of money. He’s a bondholder. Bobby Bondholder.

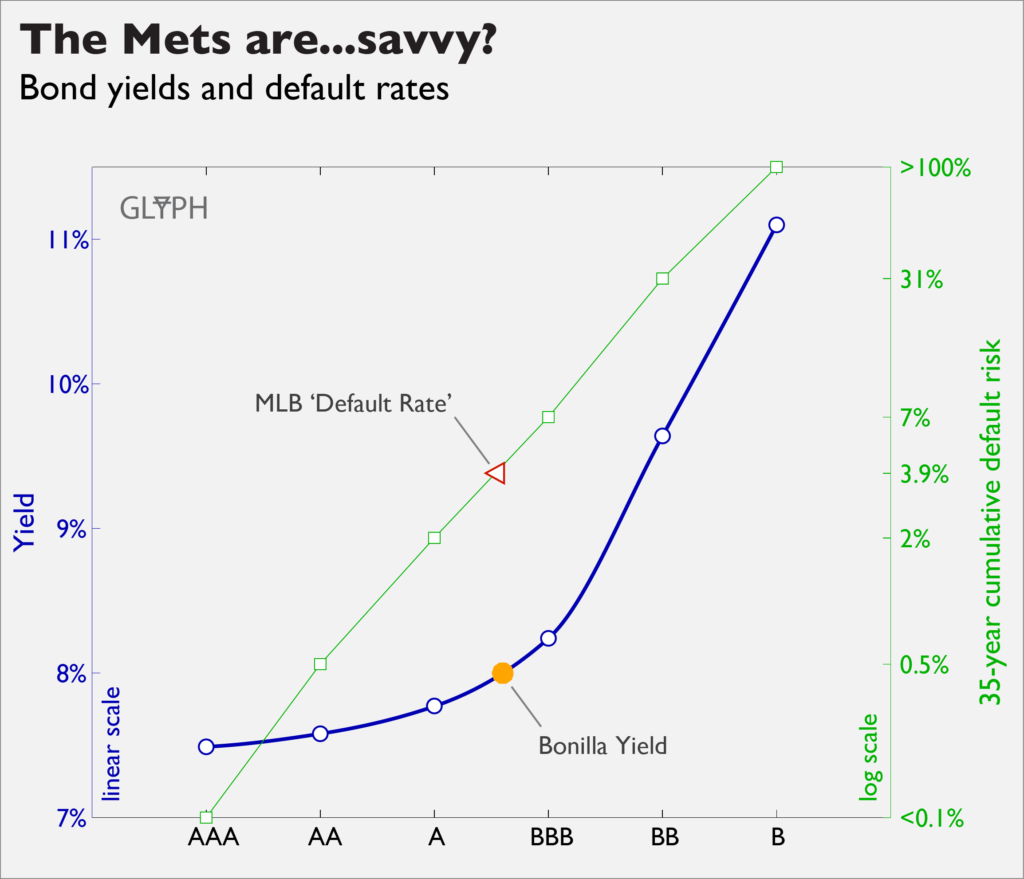

The blue curve is the yield of six tiers of corporate bond as of 01-Jan-20007 8 9 10 11 12, which would have been the most up-to-date rates at the time the Mets and Bobby Bondholder were negotiating and signing the contract. The alphabetical ratings on the abscissa are known as bond credit ratings and they describe the perceived ability of the borrower to repay the loan13. Highly-trustworthy borrowers (AAA) are at the left side of the axis, and pay a relatively low interest rate, reflected in a lower nominal yield. Less-trustworthy borrowers pay higher interest rates, so that the people loaning them money (bondholders) are compensated for the additional risk. The Bonilla bond is between an A and a BBB, which are associated with the following tier descriptions:

An obligor rated ‘A’ has STRONG capacity to meet its financial commitments but is somewhat more susceptible to the adverse effects of changes in circumstances and economic conditions than obligors in higher-rated categories.

An obligor rated ‘BBB’ has ADEQUATE capacity to meet its financial commitments. However, adverse economic conditions or changing circumstances are more likely to lead to a weakened capacity of the obligor to meet its financial commitments.

Standard and Poor’s

which I think we can all agree is an extremely clear distinction and there is no way that failures in bond evaluation could have abetted a massive financial crisis. Also, “Obligor” sounds like some shit you would find in the Monster’s Manual, e.g., “Obligor, Demon Lord of Gluttony”.

The 8% interest rate paid by the Mets in the “35-year Bonilla-Y2K” bond is an implicit agreement that their credit rating was between A and BBB as of January 2000. Was this correct? As you might expect, the default rate of bonds of various credit ratings is something that people keep track of 14 and they’re provided on the right ordinate above. Because Bobby Bondholder is not well-diversified, holding all of his assets in a single 35-year bond, he is worried about the cumulative default risk over that 35-year period, which is why that number is used instead of an average rate.

That marked point between A and BBB on the default curve almost precisely shares the credit rating of the Bonilla bond. In the 35 MLB seasons between Jan-1965 and Jan-2000, there were 904 “team-seasons” played, so we can say that there was an average of 25.8 teams in MLB over that time period. There was one team bankruptcy in that time period 15, for an average cumulative default rate of 3.9%. This is the marked point–the 8% the Mets and Bonilla agreed on are pretty much exactly what you would expect from the backward-looking default rate of MLB teams.

In light of its infamy, the craziest thing about the Bonilla contract is apparently that there is absolutely nothing weird about it. Some coverage16 does mention the ubiquity of deferred money and how unremakable the contract was at the time, but there tends to be a mention of Bernie Madoff as a mitigating factor. It’s certainly not irrelevant to the way the Mets owners viewed the contract, but you also don’t need to invoke world’s largest Ponzi scam in order to explain the return.

Bobby Bonilla Day has by now kind of eclipsed Bobby Bonilla the player, but Bobby Bonilla was pretty good. 16 seasons, 6 All-Star nods, 2000 hits, 287 HR…not going to the Hall, but pretty good. Bobby Bondholder? Totally average.

- https://nypost.com/2019/03/27/jacob-degrom-will-be-next-bobby-bonilla-with-mets-contract/

- https://www.baseball-reference.com/players/b/bonilbo01.shtml

- https://www.chicagotribune.com/news/ct-xpm-2000-01-04-0001040254-story.html

- https://twitter.com/mikemayerMMO/status/1145622885878435840?s=20

- https://en.wikipedia.org/wiki/Fred_Wilpon#Madoff_investment_scandal

- https://legacy.baseballprospectus.com/compensation/cots/?s=sutter

- AAA tier: https://fred.stlouisfed.org/series/BAMLC0A1CAAAEY

- AA tier: https://fred.stlouisfed.org/series/BAMLC0A2CAAEY

- A tier: https://fred.stlouisfed.org/series/BAMLC0A3CAEY

- BBB tier: https://fred.stlouisfed.org/series/BAMLC0A4CBBBEY

- BB tier: https://fred.stlouisfed.org/series/BAMLH0A1HYBBEY

- B tier: https://fred.stlouisfed.org/series/BAMLH0A2HYBEY

- https://en.wikipedia.org/wiki/Bond_credit_rating

- https://www.spratings.com/documents/20184/774196/2018AnnualGlobalCorporateDefaultAndRatingTransitionStudy.pdf

- The Seattle Pilots

- https://www.espn.com/video/clip/_/id/17669446